Microfinance

On this page

Boost the performance and transparency of your microfinance operations with digital solutions tailored to your market.

Across Africa, millions of people remain outside the reach of traditional banking services. Microfinance institutions (MFIs) are at the forefront of financial inclusion, operating in both bustling urban centres and remote rural communities. Every day, mobile credit officers travel to meet clients, assess loan applications, collect repayments, and monitor ongoing cases, often in challenging environments.

Targa Telematics equips MFI managers with powerful digital tools that deliver instant visibility over field teams and vehicles: live location, verified data, centralised communication, and secure movement monitoring, even in areas with limited connectivity.

Our solutions address the sector’s most pressing challenges: supervising credit officers, safeguarding transported funds and documents, reducing travel costs, preventing fraud, and enhancing client satisfaction.

The objectives we help you achieve

For the microfinance sector, Targa Telematics offers tailored solutions and services designed to meet the specific requirements of each organisation, every field assignment, and every vehicle fleet.

- Reduce operational and transport costs

- Improve productivity and field coverage

- Ensure compliance and mission traceability

- Respond quickly to unforeseen events

- Protect agents and vehicles

- Strengthen customer trust through reliable data

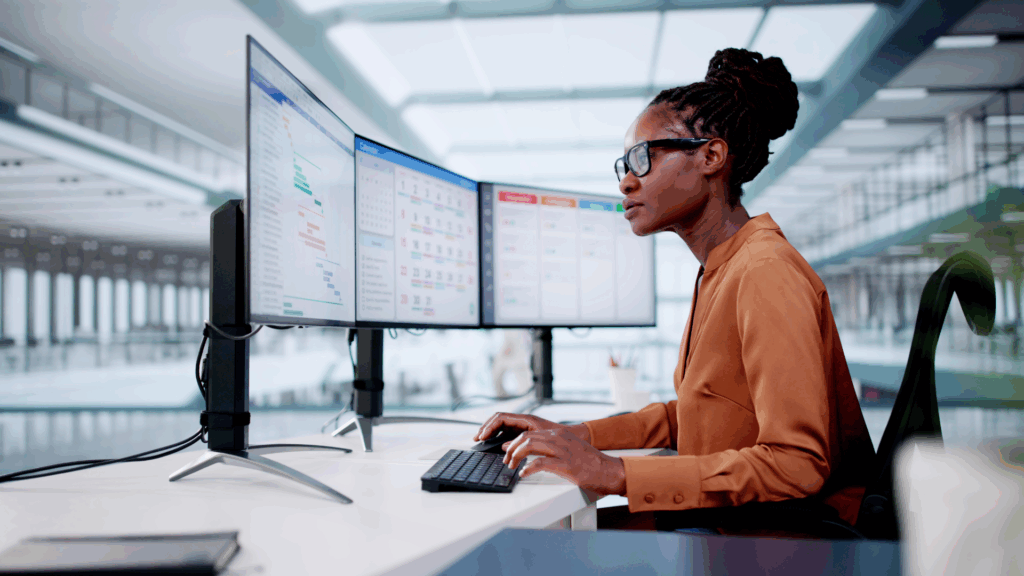

Monitoring and Supervision of Interventions

This module provides full visibility over both ongoing and completed missions. Through an intuitive map and dashboard, fleet managers can track agent locations and progress in real time, access detailed mission and route histories, and receive instant alerts in case of delays or anomalies.

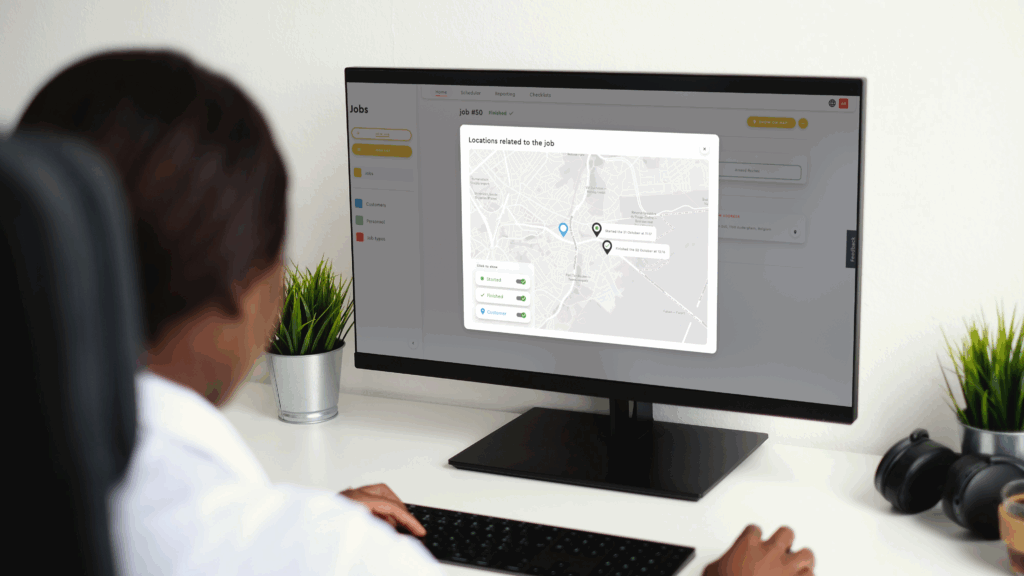

Credit Officer Coordination

This module simplifies mission allocation and communication with agents. With real-time visibility on availability and location, managers can assign tasks more efficiently and quickly reallocate missions in case of absence or emergency.

Corporate Fleet Management

Our solution ensures accurate monitoring of vehicles dedicated to microfinance missions. Managers benefit from live location tracking, usage control, and detailed fuel consumption analysis, with anomaly detection to prevent losses or misuse. Preventive maintenance features help reduce downtime, while geofencing secures key zones and points of interest. The system also provides proof of visit and schedule adherence, ensuring reliability and accountability in every mission.

Reporting and Traceability

With our digital reporting tools, paper notebooks and manual data entry are replaced by efficient, automated processes. Field agents can complete digital forms enriched with photos and comments, instantly transmitted to headquarters. All data is automatically consolidated, making audits easier and enabling seamless client follow-up, while ensuring full traceability of activities.

Vector

Optimise your field team and intervention management